CONFIDENTIAL – FOR PROFESSIONAL INVESTORS ONLY

Manager Statement

The fund manager, SL Investment Management (“SL”), is pleased to report that 2022 has been another good year for BlackOak Fund (“BlackOak” or the “Fund”). The Fund performance for the year was 11.4%, with further expansion of the portfolio and a corresponding increase in diversification.

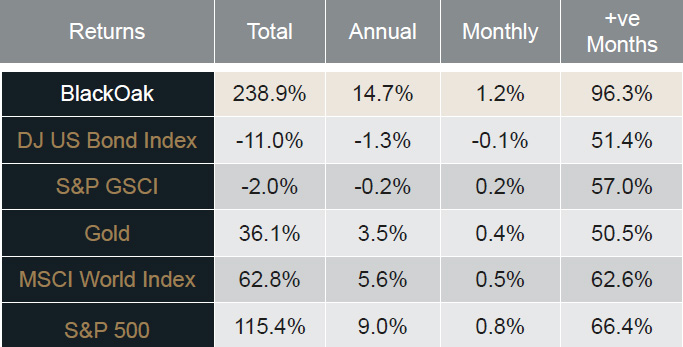

Total performance since Fund inception represents an average monthly return of 1.2%, with 103 out of 107 months achieving positive growth. These levels of performance are exceptional when compared against other mainstay indices over the same period.

Performance

BlackOak has consistently performed throughout 2022, continuing to demonstrate low volatility and limited correlation to traditional asset classes since the Fund’s launch in 2014:

Performance Since Launch (Feb 2014):

Performance is fundamentally driven by maturity events which will tend to emerge as the portfolio becomes more established.

Why? Because policy holders who are looking to sell, but consider themselves to be in very poor health, often choose to maintain their life cover rather than to proceed with a sale.

Therefore, the performance of the portfolio should continue as it becomes more seasoned, and the instances of maturity events increases.

Global Market Backdrop

In January 2022 the IMF predicted that global inflation “should gradually decrease as supply-demand imbalances wane in 2022 and monetary policy in major economies respond”. They noted potential downsides with regards to new COVID variants and supply side disruption, and the risk of energy price volatility. The last of these was remarkably prescient.

In February 2022 Russia’s invasion of Ukraine had significant consequences for markets. When war broke out, more than 10% of the world’s wheat, barley and grain were grown in Ukraine, and the disruption to the food market led to increased prices on these staples of global food.

Of more consequence, in 2021 Russia produced 14% of the world’s oil and natural gas. The shock to this market led to global energy prices soaring, with corresponding inflationary pressures rippling across the globe.

Inflation in the US peaked at 9.1%, and EU inflation peaked at 10.6%, both the highest in forty years, while the IMF forecast a global inflation rate of 8.8% in 2022. In response, central banks drew on the largest weapon in their armoury, increasing interest rates.

The Federal Bank increased interest rates towards 4.5% in the US, and the ECB increased interest rates to 2.5% in the Eurozone.

Whilst historically these rates are not high, after a decade of extremely low interest rates the increases are significant to individuals and businesses carrying high levels of debt. Allied with these increases in interest rates impacting citizens and businesses, many governments have incurred additional debt supporting their citizens in the affordability of energy prices.

It is still unclear how prepared global markets are for this recent shift to higher interest rates and increased debt for individuals, businesses and countries. One initial consequence was US currency strengthening against most other major currencies as investors sought the relative safe haven of the US dollar. Also in 2022, the S&P 500 fell by 19%, the MSCI World Index by around 20%, and the corporate bond index dropped by 17%.

The commodity index increased by 26% as price inflation in these areas saw increased profits for producers who saw prices rise whilst some costs remained constant; but 2022 was generally a poor year for those invested in traditional asset classes such as equities and bonds.

Life Settlement Market

As a non-correlated asset, the life settlement market has remained relatively insulated from the economic fallout of the COVID 19 pandemic, and subsequent inflationary pressures from soaring energy costs associated with the war in Ukraine.

During 2021 the market had witnessed a fall in the volume of secondary policies traded. This was largely attributed to the pandemic, with seniors keen to hold onto their life cover, and social distancing restrictions making the process of selling less straight forward (e.g. seniors reluctant to meet with advisers and to sign paperwork).

At the time of writing, comprehensive market data for 2022 remains unavailable – but early indications are that submissions for the year have been up significantly.

In the tertiary market, where existing portfolio owners trade between each other, there has also been an increase in activity during the year. We received and analysed almost 40 portfolios with an aggregate face amount exceeding $5bn. This compares to around 30 portfolios with $3.5bn in face during 2021.

With continued volatility in traditional markets, more investors have been attracted to alternative asset classes. Public awareness of life settlements and their minimally correlated nature has grown. This has ensured that demand remains high with strong competition for policies in both the secondary and tertiary markets. As a result, market prices have been stable during 2022, further demonstrating the asset’s resilience to external factors such as interest rate increases introduced by central banks.

Looking ahead to 2023, we expect direct supply to increase further:

- Inflation will continue to increase the cost of living resulting in more policyholders looking to sell their policies to supplement their income.

- Continued growth in the direct-to-consumer market will drive efficiencies and make the selling process simpler.

- Marketing initiatives such as TV advertising will continue to increase awareness of the life settlement option amongst seniors.

The tertiary market is now well established and offers existing investors access to liquidity as well as the opportunity to re-balance their portfolios to manage diversification. As the number of in-force policies in portfolios has grown, so has the size of the tertiary market and we expect further growth in 2023.

Interest rates are expected to remain elevated in the coming months, with recession predicted for some of the larger economies – there is little sign that the war in Ukraine is going to end any time soon.

As such, further turbulence can be expected in global equity and bond markets. This will likely see new and existing investors continuing to allocate funds to alternative investments including life settlements, ensuring that available capital (hence demand) will remain strong.

With supply volumes on an upwards trend, the market is well positioned to build on the growth of previous years.

Our extensive secondary and tertiary supply networks developed over the last 30 years stands the fund in good stead.

US Inflation

Rising inflation has been a key concern for investors in 2022, along with the rising interest rates implemented to counter inflationary pressures. The Federal Open Market Committee (“FOMC”) is responsible for assessing US economic indicators and steering monetary policy by setting the target range for the federal funds rate.

The federal funds effective rate began 2022 at 0.08%. Throughout the year, the FOMC has increased the rate in reaction to inflationary news. At their last meeting in December the effective rate was increased to 4.3%, the highest level for 15 years.

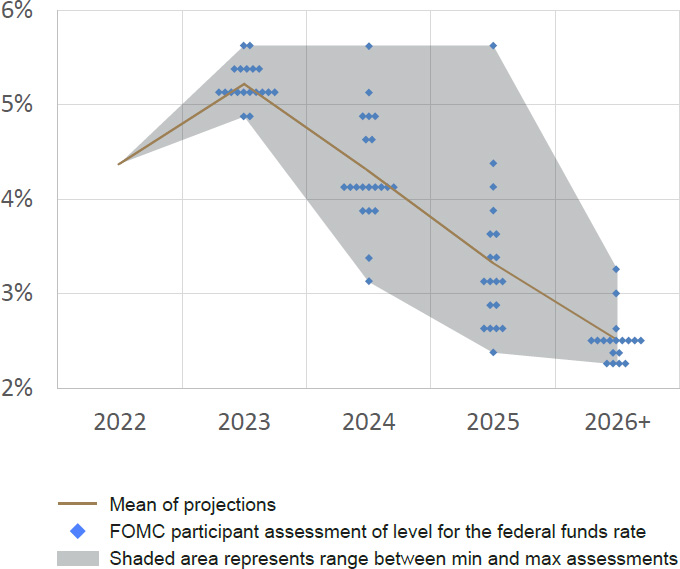

However, projections published by members of the FOMC show consensus that inflation, driven by recent energy price hikes, should be short lived.

FOMC’s view appears to be that the target federal fund rate should peak at just over 5% in 2023, and gradually fall back to 2.5% in 2026 and beyond.

Meanwhile markets appear perhaps more optimistic than the FOMC, with recent falls in fixed income yields suggesting that rates may peak sooner and fall faster than FOMC predictions.

FOMC federal fund rate projections – 14 December 2022:

Regardless, life settlement yields have remained remarkably resilient over the past five years, consistently lying between 10% and 12%.

The nature of the life settlement market, where capital raising and portfolio construction typically happens over relatively long periods of time, means that transient movements in underlying rates can have little impact on market yields.

Coupled with the uncorrelated features of the asset, we expect this trend to continue through-out 2023 and beyond.

Financial Strength

The counterparties in a life settlement investment are US insurers. Monitoring their financial strength, hence their ability to pay maturity obligations, is an essential component in managing the risks associated with a life settlement investment.

The National Association of Insurance Commissioners (NAIC) brings together state level regulators, setting standards to ensure a fair, competitive, and healthy insurance market is run in the best interest of consumers. The NAIC, in conjunction with state level regulators, developed the risk-based capital (RBC) ratio as a key method of monitoring life insurance company solvency.

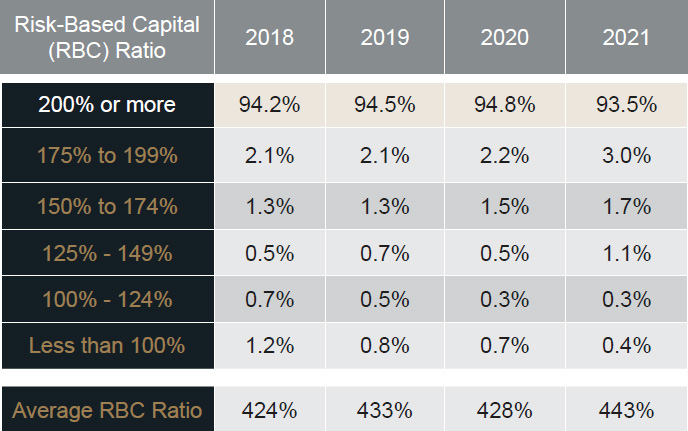

An RBC ratio of 200% is considered the minimum amount of capital an insurer must have to avoid triggering regulatory action. The ratio provides a means for evaluating the adequacy of an insurer’s capital relative to the risks inherent in the insurer’s operations.

From 1993 when life insurers began reporting RBC, the average ratio rose steadily to a plateau of 290% in 1997, which remained unchanged until 2001. That year the ratio jumped to 346%, mainly due to methodology changes enacted by the NAIC.

The ratio reached its peak of 489% in 2014 and declined until it reached 424% in 2018. From 2020 to 2021, the ratio increased 15 percentage points to 443%.

Risk-Based Capital held by Life Insurers, 2018 – 2021:

Recent increases in US federal funds rates may have had both positive and negative implications for an insurer’s RBC ratio. For example, unrealised assets on their balance sheet may devalue under established mechanisms such as the Interest Maintenance Reserve (IMR).

Conversely, the present value of future liabilities may have decreased with increasing fed rates, and future returns on cash holdings will naturally increase – both benefiting solvency. The situation is somewhat complex and we will continue to monitor the situation closely.

Regardless, we remain confident that BlackOak’s selective investment strategy, targeting policies from the most financially robust insurers, will mean that the portfolio credit risk is not expected to change materially in the foreseeable future.

SL has acquired over 70,000 insurance policies on behalf of investors since 1990, and no policy has ever failed to pay out due to an insurer insolvency.

Portfolio Development

Throughout 2022 the life settlement market has remained strong, with competition for policies showing no sign of easing.

For BlackOak, the focus for 2022 has been to keep the rate of investment in line with new capital raised, whilst maintaining the selective investment strategy that has driven the exceptional performance since launch.

We are pleased to report that this goal has been largely achieved through initiatives to consolidate and expand relationships with key sourcing partners in the US; particularly those looking to drive direct-to-consumer initiatives where we perceive better value and diversification opportunities to currently prevail.

During 2022 BlackOak has successfully deployed over $400m (face value) into new life settlement investments, with an average purchase IRR of 11.8%, well above the minimum purchase IRR allowable of 9.0%.

New life settlement investments have continued to expand portfolio diversification, with the number of insurance companies represented within the portfolio increasing from 72 to 90 over the year. The concentration of the largest insurance company, John Hancock Life remains below 10%.

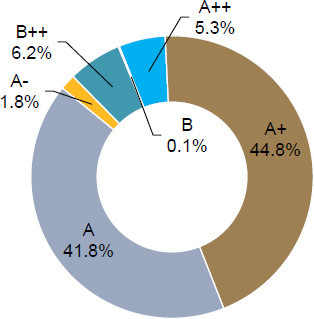

This has been achieved whilst maintaining the proportion of the portfolio with an AM Best rating of A or higher at 92%; representing the superior financial strength of the underlying insurers, and their ability to fulfil their payment obligation upon maturity.

The opportunity to adjust the distribution of Primary Health Impairments (PHIs) for lives assured in the portfolio has been undertaken in 2022. Exposure to cardiovascular conditions has been reduced from 41% to 34%, and exposure to other PHIs such as cancer rebalanced from 17% to 23%. It is important to maintain a good diversification of PHIs to smooth the impact of medical breakthroughs and their positive impact on population longevity.

Finally, the Period to Loss (PtL) for the portfolio has been improved in 2022. This is a measure of how long lives assured would need to live beyond their Life Expectancy for the policy purchase cost and premiums paid to exceed the death benefit. This has been increased from 231% to 251%, meaning that lives assured would on average have to live 2.5 times their Life Expectancy for the portfolio to become loss making.

BlackOak – A.M. Best Financial Strength Ratings Dec 2022:

source: SL Investment Management, 2023

Strategic AUM Growth

BlackOak employs a sophisticated investment strategy, developed through SL’s 30-year experience at the forefront of secondary insurance markets – advising and managing assets totaling in excess of $8.4bn.

This highly selective investment approach, where less than 5% of policies reviewed are actually acquired by clients, is the result of the disciplined analytical approach adopted by the management team.

Having analysed over 580,0001 policies, SL is able to confidently identify where the best investment opportunities are available for investors.

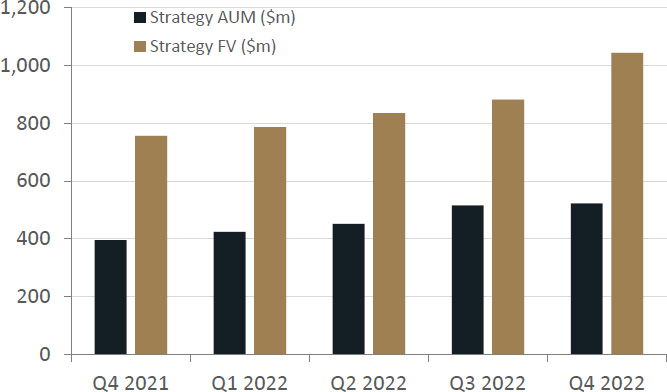

Applying this approach in the market has allowed a steady growth in capital to be deployed over the year, with the ‘strategy’ Assets Under Management² (AUM) growing by 32% from $396m ($756m face value) at the end of 2021, to $523m ($1,043m face value) at the end of 2022.

Actual to Expected analysis

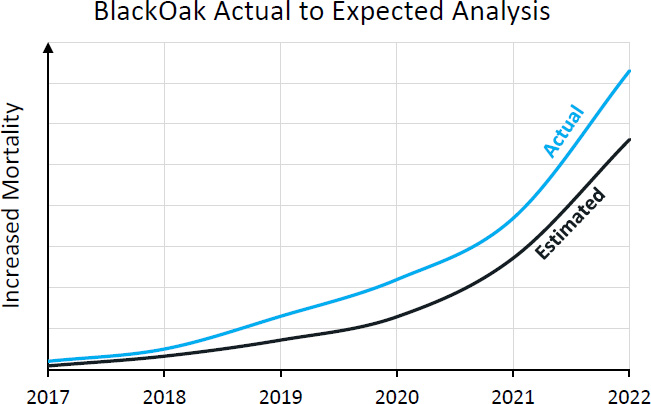

The Actual to Expected analysis (A to E) shows the occurrence of actual mortality events within a life settlement portfolio, against statistically expected mortality events as inferred from the Life Expectancy (LE) reports at the point of purchase.

A to E is a useful measure to track how reasonable underwriters’ assumptions are in assessing LEs of the lives insured.

It is also a useful indication of the manager’s ability to identify areas within the life settlement market where underwriters can be more conservative in their LE assessments (i.e. longer), and equally those areas where underwriters may be overly aggressive (i.e. shorter in their assessments).

A successful life settlement manager will focus their investment programme to acquire policies where the underwriters tend to be consistently longer in their assessments, and avoid areas where underwriters are typically shorter.

The A to E for BlackOak indicates that mortality events experienced by the fund to end 2022 have been 130% when compared to those inferred from the original LE assessments. In other words, there have been 30% more mortality events experienced by BlackOak to date than predicated by the original LE reports, and a corresponding increase in performance since inception.

Outlook 2023

Global events during 2022 have been largely defined by the war in Ukraine, the resulting increase in energy prices, and corrective measures implemented by central banks to stem inflation.

These events have caused havoc across mainstay capital markets, with both equities and fixed interest indices down significantly over the year.

However, life settlement yields have remained remarkably resilient; and we expect this trend to continue in 2023 as demand remains strong.

Market sentiment suggests that inflationary pressures should be short lived, supported by a price fall¹ in oil from a peak of nearly 120 USD/Bbl shortly after Russia invaded Ukraine, to 78 USD/Bbl today.

Once this softening of energy prices filters through to global economies, central bank focus will no doubt return to the issue of growth, with Fed rates anticipated to gradually reduce to 2.5% over the next 3 years to provide the necessary stimulus.

As a consequence, whilst traditional capital markets may continue to experience volatile months ahead, we anticipate life settlement yields to remain stable, with increased interest from investors seeking minimally-correlated alternatives such as life settlements.

We expect secondary market supply to continue its upward trend as public awareness of the life settlement option grows; especially with direct-to-consumer initiatives gathering pace.

In 2022, the American Council of Life Insurers estimated that in the US there were around 261 million in force life insurance policies, representing $21.2 trillion of death benefit; an increase of 3.7%² from the 2021 estimate.

The Conning 2022 annual report on the life settlement industry projects that the gross life settlement market potential between 2022 and 2031 will average $220bn (face value) per year; with the annual volume increasing over that period as the baby boomer generation reaches retirement age.

With average life insurance lapse rates in the US persisting, there remains significant untapped potential in the secondary market.

With corresponding growth anticipated in the tertiary market, and senior longevity in the US showing no sign of improvement, the overall outlook for the asset class in the coming years remains positive.

Disclaimer

This material is intended for “investment professionals” as defined in article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 and must not be acted or relied upon by other persons.

The information and opinions published herein do not constitute an invitation or offer to buy or sell Life Settlements or other financial instruments, nor an invitation or offer to undertake other transactions. They are published purely for information purposes.

The information and opinions published herein constitute neither recommendations nor guidance for decisions concerning your investments and other matters, and do not have any advisory character whatsoever. Therefore, before making any investment or other decisions, you should seek the advice of a qualified specialist.

This material and the copyright in the content are owned by SL Investment Management Limited.